An important deadline for many 1199 state members is fast approaching.

When SEBAC entered into negotiations over pensions and insurance, 1199ers will recall that the State was going after our pension hard as an unsustainable benefit, after years of not-so-benign neglect and severe underfunding of our Pension Plan put our future benefits at risk.

To keep our Pension Plan secure and healthy, SEBAC’s agreement with the state calls for changes to retirement age eligibility beginning July 1, 2022 (except for individuals who retire under the Hazardous Duty provisions of the SERS Pension). We did preserve the eligibility of State employees to elect retirement at age 60 or 62 with the agreement described below.

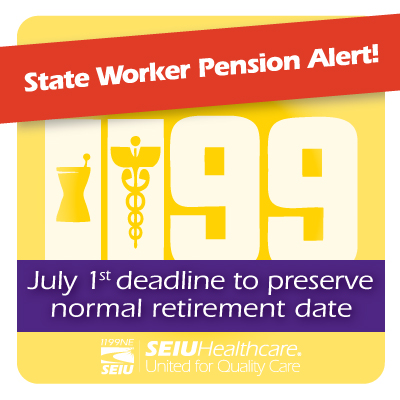

The Normal Retirement Date will not be raised until July 1, 2022. However, 1199 members in SERS Tier II, IIA, or the Hybrid who want to preserve the current Normal Retirement Date must elect to do so by July 1 of this year.

Choosing this option will require an additional contribution on a continual basis beginning the first full pay period following July 1, 2013. The costs of that contribution will be based on the actuarial pension cost of maintaining the normal retirement eligibility in the present plan. Those who are eligible to make this choice have received a memo from their HR Office.

1199 members can estimate their bi-weekly cost by using a “Grandfathering of Retirement Age Calculator” on the Comptroller’s website. The Comptroller has also provided a Q & A about the option. Go to http://www.osc.ct.gov.

This does NOT affect participants who plan to stay in the ARP (Alternate Retirement Plan), those hired after July 1, 2011, or those who will reach their Normal Retirement Age prior to July 1, 2022.

ARP members who are waiting for the IRS to rule on whether it will allow members to transfer from the ARP to SERS will also have an opportunity to preserve the current normal retirement date should they decide to transfer to the Hybrid or to SERS. They will have to pay the full actuarial cost.

Update on Workers Who Will Reach Normal Retirement Age by 2022

SEBAC and the State have now reached agreement on one of the unresolved pension questions raised in “Attachment F” of the SEBAC Pension Agreement, regarding workers who reach normal retirement age by July 1, 2022 but continue to work in state service.

| Question: What if I have already reached normal retirement age by 7/1/2022 but still keep working? | Answer: You will retain that normal retirement age and NOT be subject to the post 2022 retirement age. There are no additional contributions due under Attachment F. |

The parties are in agreement that people who reach normal retirement age during the month of June 2022 are considered to have reached normal retirement age “by 7/1/2022” and that the answer to Question Number 4 therefore applies.